USA 26% RECIPROCAL TAX ON INDIA | ITS AN OPPORTUNITY OR THREAT

President Trump has recently announced the implementation of “reciprocal tariffs” on goods imported into the United States from various countries, including India. This move, declared on April 2, 2025, and dubbed “Liberation Day” by the President, aims to address what the U.S. perceives as unfair trade imbalances.

According to President Trump, he thought that other countries are doing unfair trade practice by putting heavy texas on the USA goods, so he implement the reciprocal tax, According to what same percentage of tax or trade restriction that other country imposes on USA in response to similar actions taken by USA on that particular country.

Here’s a breakdown of the situation:

Baseline Tariff: A universal 10% tariff has been imposed on all imports entering the U.S., effective April 5, 2025.

Country-Specific Tariffs:

Starting April 9, 2025, higher “discounted reciprocal tariffs” will be applied to countries with significant trade surpluses with the U.S. These tariffs are intended to match, at a discounted rate, the duties that these countries allegedly impose on American goods.

Tariff on India: India faces a 26% discounted reciprocal tariff on all its merchandise exports to the U.S. Some sources initially reported 27%, but a later White House document revised it to 26%. This tariff is based on the U.S. assessment that India has an average effective barrier of 52% on American goods.

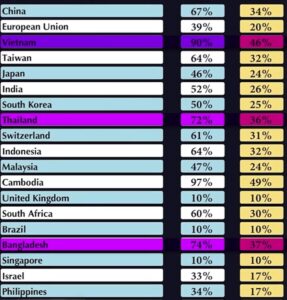

Comparison with Other Nations: India’s 26% tariff is lower than those imposed on some other Asian countries, such as Vietnam (46%), Bangladesh (37%), Thailand (36%), Sri Lanka (44%), and Pakistan (30%). This difference could potentially offer Indian exporters a slight “comparative advantage.”The list show the tarif charged by other countries on US goods and and US reciprocal tax on particular country.

Impact on Indian Exports:

Heavily Affected Sectors:

Gems and jewelry, a significant export sector worth around $10 billion annually to the U.S., is expected to be significantly impacted by the jump from a previous average duty of about 2.1% to 26%.

Electronics are also anticipated to face considerable challenges. Automobiles and auto components might also be affected.

Less Affected or Exempt Sectors:

Pharmaceuticals and certain metals appear to be exempt from this new tariff. The impact on agricultural exports like seafood and rice might be less severe compared to some regional competitors.

Potential Opportunities for India: Some experts suggest that the new tariff landscape could create opportunities for India. The 10-20% cost advantage over countries facing higher tariffs might lead to increased order flows for Indian exporters in certain sectors like textiles and steel, especially as tariffs on China rise.

Impact on the Indian Economy: While the tariffs are a concern for export-oriented sectors, some analyses suggest that the overall impact on India’s GDP might be minimal. India’s growing strength in manufacturing and services exports could help offset the effects.

India’s Response: The Indian government is currently reviewing the impact of these tariffs and is considering various responses. This includes potential duty reductions under a bilateral trade agreement being negotiated with the U.S., which is expected to be finalized by autumn. India is also exploring new trade alignments and safeguards against potential dumping of goods from countries heavily affected by the U.S. tariffs.